Irs Form Schedule A 2024 Instructions – According to the IRS, 20% of eligible taxpayers don’t know about the Earned Income Tax Credit, yet it could add thousands of dollars in tax savings back into their pockets. . Capital gains are the profit you make when you sell a capital asset (such as real estate, furniture, precious metals, vehicles, collectibles or major equipment) for more money than it cost you. The .

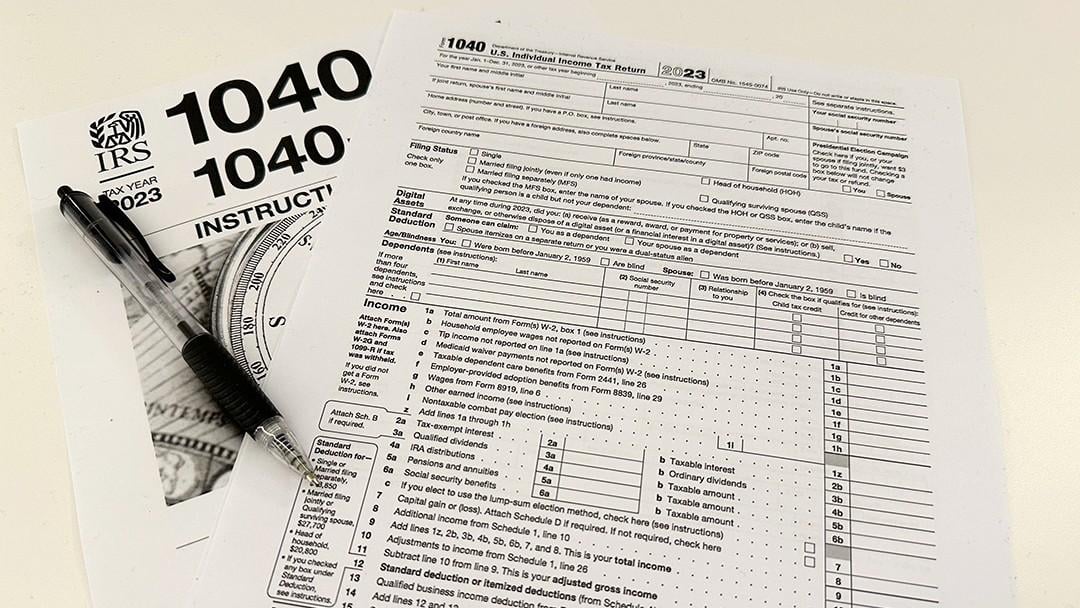

Irs Form Schedule A 2024 Instructions

Source : www.irs.govIRS Releases Updated Schedule 1 Tax Form and Instructions for 2023

Source : www.rochesterfirst.com2023 Instructions for Schedule C

Source : www.irs.govTax season begins: What to know for filing this year | KOSU

Source : www.kosu.orgInstructions for Schedule R (Form 941) (Rev. March 2024)

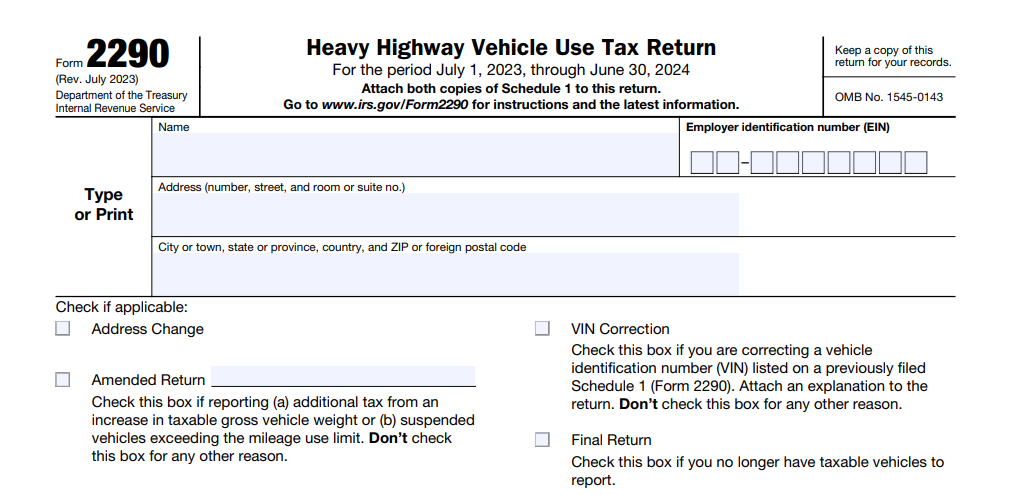

Source : www.irs.govInstructions for IRS Form 2290 | How To File Form 2290 for 2023 2024

Source : www.ez2290.comIRS Releases Schedule H Tax Form and Instructions for 2023 and

Source : fox5sandiego.comArizona, federal tax season begins with changes, tips for filers

Source : yourvalley.netTax Season is Under Way. Here Are Some Tips to Navigate It

Source : news.wttw.comBusiness Tax Renewal Instructions | Los Angeles Office of Finance

Source : finance.lacity.govIrs Form Schedule A 2024 Instructions Instructions for Schedule M 3 (Form 1120 PC) (Rev. January 2024): The due date is approaching and it is once again time to file your tax returns. Filing taxes for 2023 can feel overwhelming, but with the right guidance, you can determine how to navigate . Californians pay the highest marginal state income tax rate in the country — 13.3%, according to Tax Foundation data. But California has a graduated tax rate, which means your rate increases with your .

]]>

!role~Preview!mt~photo!fmt~JPEG%20Baseline)